Bitcoin (BTC) price continues to trade below its 2023 high, a sign that investors may have underestimated the strength of the $44,000 resistance. Even as BTC price trades below $42,000, it doesn’t necessarily mean that reaching $50,000 and beyond is no longer possible. In fact, quite the opposite seems more likely to occur. Looking at Bitcoin derivatives metrics, it is clear that traders ignored the 6.9% drop and remained optimistic. However, is this optimism enough to justify further gains?

The $127 million liquidation of leveraged long Bitcoin futures on Dec. 11 may seem significant in absolute terms, but it represents less than 1% of the total open interest – the value of all outstanding contracts. Nevertheless, it’s undeniable that the liquidation engine triggered a 7% correction in less than 20 minutes.

Bitcoin’s crash was accelerated by derivatives, at least in the short-term

On one hand, one could argue that derivatives markets played a crucial role in the recent negative price movement. However, this analysis overlooks the fact that after hitting a low of $40,200 on Dec. 11, Bitcoin’s price increased by 4.2% in the following six trading hours. In essence, the impact of forceful liquidation orders had dissipated long ago, disproving the notion of a crash solely driven by futures markets.

To determine if Bitcoin whales and market makers are still bullish, traders should examine Bitcoin futures premium, also known as the basis rate. Professional traders prefer monthly contracts due to their fixed funding rate. In neutral markets, these instruments trade at a premium of 5% to 10% to account for their extended settlement period.

Data reveals that the BTC futures premium barely fluctuated despite the 9% intraday price drop on Dec. 11, as it remained above the 10% neutral-to-bullish threshold throughout. If there had been significant excess demand for shorts, the metric would have at least dropped into the neutral 5% to 10% range.

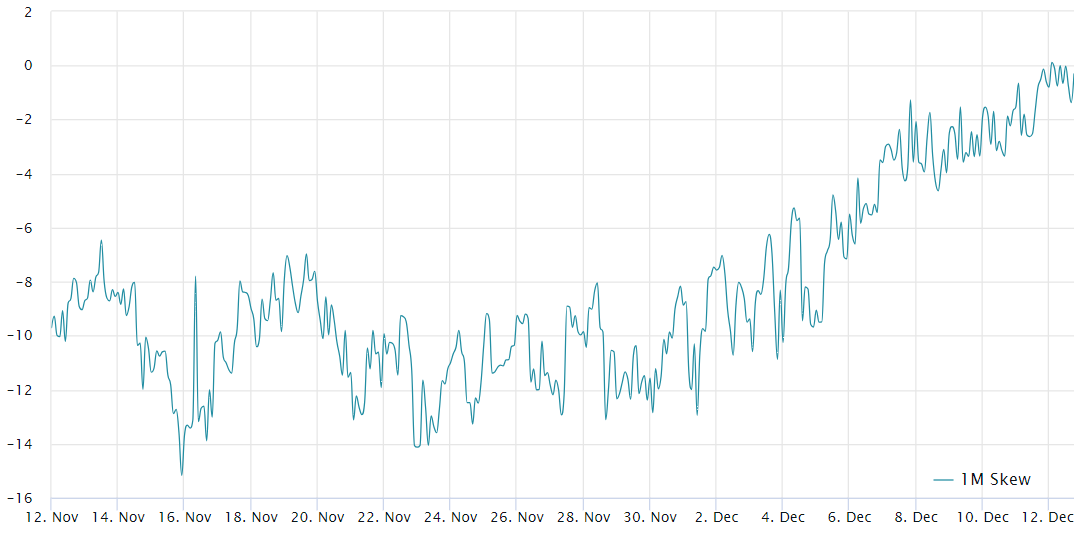

Traders should also analyze options markets to gauge whether the recent correction has dampened investor optimism. The 25% delta skew is a telling indicator when arbitrage desks and market makers charge excessively for upside or downside protection.

If traders expect a Bitcoin price drop, the skew metric will rise above 7%, and periods of excitement tend to result in a negative 7% skew.

As shown above, the BTC options skew has been neutral since Dec. 5, indicating a balanced cost for both call (buy) and put (sell) options. It’s not as optimistic as the prior couple of weeks when put options traded at a 10% discount, but it at least shows resilience after the 6.1% correction since Dec. 10.

Retail traders remained neutral-to-bullish despite Bitcoin’s fluctuations

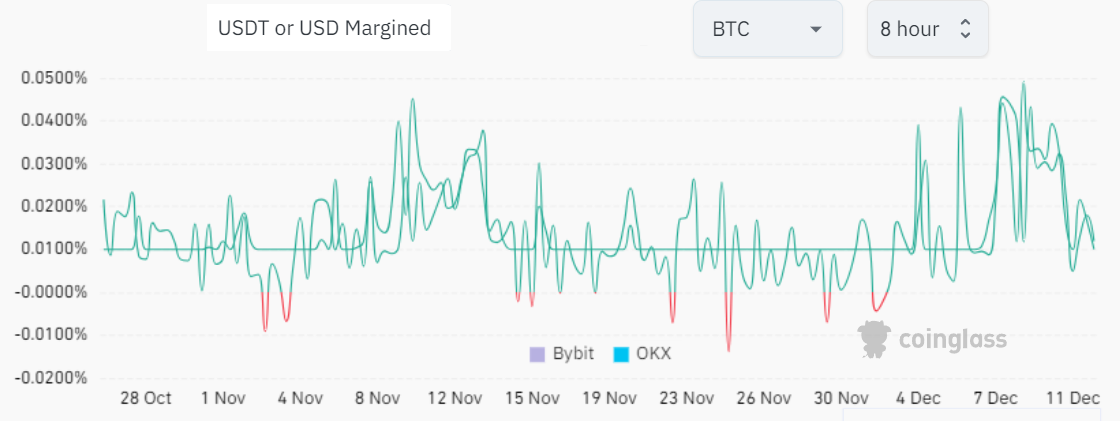

After covering two of the most relevant indicators for institutional flow, one should analyze whether retail traders using leverage influenced the price action. Perpetual contracts, also known as inverse swaps, include an embedded rate that is typically recalculated every eight hours.

A positive funding rate indicates increased demand for leverage among long positions. Notice that data reveals a modest increase between Dec. 8 and Dec. 10 to 0.045%, equivalent to 0.9% per week, which is neither significant nor burdensome for most traders to maintain their positions.

Related: El Salvador’s Bitcoin bond gets regulatory approval, targets Q1 launch

Such data is quite healthy, considering that Bitcoin’s price has surged by 52% since October. It suggests that excessive retail leverage longs didn’t drive the rally and subsequent liquidations.

Whatever caused the rally to $44,700 and its subsequent correction to the current $41,300 appears to be primarily driven by the spot market. This doesn’t necessarily mean that the bottom is in, but it significantly reduces the odds of cascading liquidations due to excessive optimism tied to the expectation of a spot exchange-traded fund (ETF) approval.

In essence, this is good news for Bitcoin bulls, as derivatives indicate that positive momentum hasn’t faded despite the price correction.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.