Bitcoin (BTC) began to show fresh signs of an impending correction on March 31 as BTC price action began to eat into last weekend’s CME futures gap.

Up or down, CME futures gaps provide targets

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD abruptly spiking down by $1,000 in minutes on Bitstamp after March 31’s Wall Street open.

The pair had ranged after failing to cement $48,000 as support earlier in the week, amid calls for a retest of lower levels as a necessary step after considerable gains.

At the time of writing, Bitcoin circled $46,700, having hit its lowest levels since the night of March 27.

A look at the CME futures chart showed that short-term price performance could have a downside target in the form of the “gap” left over from last weekend.

CME futures ended trading at around $44,650 on March 25, only to open on March 28 at $46,725.

The resulting “gap” could very well get “filled” based on historical precedent, meaning that Bitcoin would be in for a further $2,000 dip.

Popular Twitter account @CivEkonom, nonetheless, noted that a “stealthy” previous gap from last year between $52,000 and $54,000 also remained open.

“Gaps always get filled on The CME Bitcoin futures,” he commented.

Everything according to plan

The retest, meanwhile, fell into the short-term gameplan for some popular traders.

Related: Bitcoin just regained a key price trendline after its longest absence since March 2020

In an update on the day, Anbessa said that he likewise favored a return to the mid-$44,000 range, while only a deeper move would challenge his so far bullish perspective.

#Bitcoin Gameplan Update ✔️

Following green projection:

-Resistance hit after 27% bounce from channel support

– 360MA HTF target hit (slightly above)

– channel breakoutNow:

– green projection stays in tact if S/R flip above $44,333

-prefer retest, patience here @ resist pic.twitter.com/sjzUdeduF9— AN₿ESSA (@Anbessa100) March 28, 2022

Cheaper coins would further favor the main buyer of late March, Blockchain protocol Terra, buy-ins from which reached 30,000 BTC on March 31.

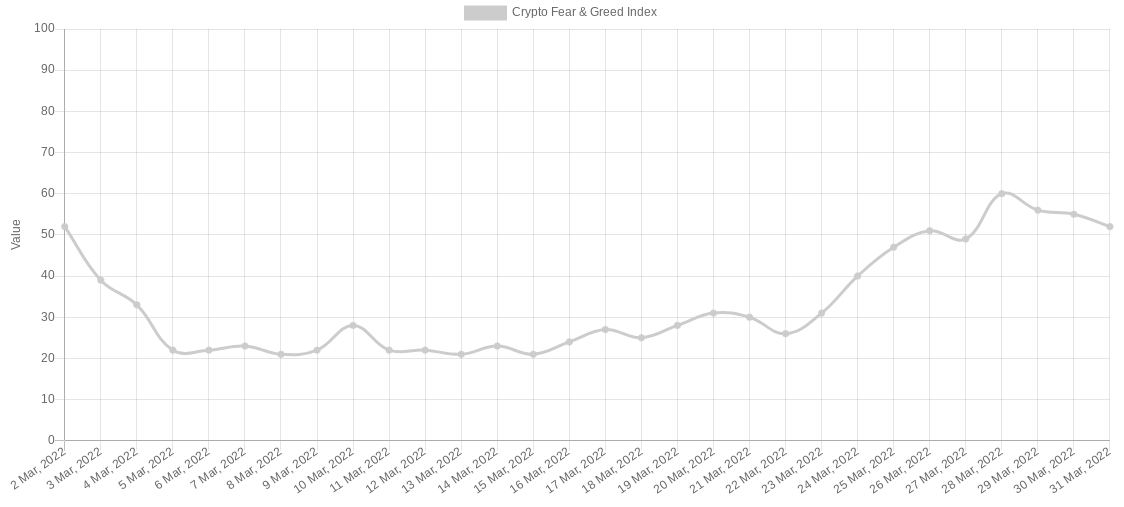

Cross-crypto sentiment, meanwhile, also continued to adjust down, the Crypto Fear & Greed Index having hit t”greed” territory for the first time in 2022.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.