Bitcoin (BTC) and crypto are only used by 13.7% of Americans, but they generate more exchange volume than anyone else.

The latest data compiled by exchange Huobi confirms that in 2022, the United States is the most “mature” cryptocurrency market.

U.S., Vietnam lead the way on crypto

Despite the heavy drawdowns in price for Bitcoin and altcoins this year, interest throughout the world remains “extremely active,” and the leaders may come as a surprise.

In its latest annual report, Huobi Research, an affiliate of Huobi Global, revealed that the U.S. accounts for 9.2% of global centralized exchange (CEX) volume. When it comes to DeFi, the figure is even higher — 31.8% of global volumes.

At the same time, the percentage of the population using crypto is not as high as in some other jurisdictions. 13.7% of Americans use crypto, the report said, compared to 20.3% Vietnam, the leader out of the 15 countries examined.

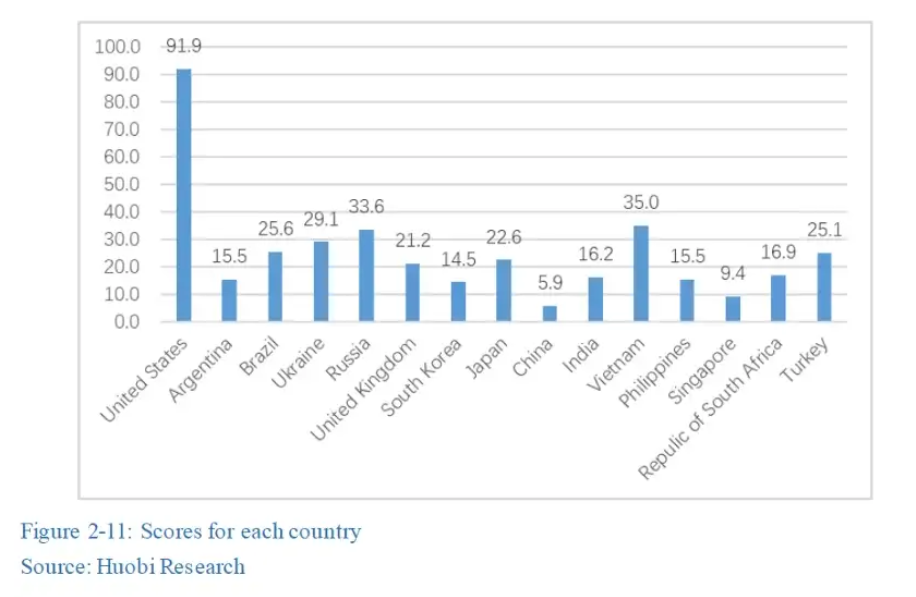

Overall, however, the U.S. achieved the highest normalized score for “crypto market maturity,” far ahead of any competitor. Second on the list is Vietnam, with a score of 35 versus 91.9 for the U.S.

Nonetheless, Huobi describes Vietnam as the country with the “highest adoption rate in cryptocurrency” and calls the crypto trading scene in both South Korea and Japan “extremely active.”

“Japan and South Korea have contributed tremendous traffic to exchanges. Specifically, South Korea ranked second with 7.4% and Japan ranked sixth with 3.85% in Asia,” the report noted.

At the other end of the spectrum, the countries with the lowest maturity score are China, Singapore and South Korea, with 5.9, 9.4 and 14.5, respectively.

Singapore stands out with its position, given the rate of regulatory expansion and acceptance of cryptocurrency as a technology.

“Singapore has become the best destination for technology startups, luring a large number of innovators and unicorn companies, which naturally includes the crypto players,” Huobi wrote.

“Singapore maintains highly tolerance and openness for the crypto industry: regulations are enforced, but there is still plenty of room for innovation.”

The report nonetheless identifies only 4.9% of Singapore’s population trading crypto, contributing 0.8% of global CEX volumes, with an internet population index of just 2/100.

“Appropriate” regulation would prevent FTX black swan

The report meanwhile acknowledges that the regulatory situation is tenuous for crypto in the wake of the FTX scandal.

Related: Will Grayscale be the next FTX?

Despite this, FTX is not the biggest catastrophe of the year for crypto, it says, with the Terra LUNA debacle and Three Arrows Capital (3AC) insolvency more pressing.

“The FTX bankruptcy is the third most influential incidents in 2022 after the collapses of Terra and 3AC,” it commented.

“The main issues of the FTX case are the misappropriation of funds, affiliate transactions with Alameda Research, etc. At the time, some U.S. regulators expressed that they were investigating or had already started investigating the issues a few months ago. However, the FTX incident will not happen if regulations of crypto assets in various countries are appropriately in place.”

Cointelegraph continues to report extensively on the latest events surrounding FTX and its impact on the crypto market.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.