Top Stories This Week

Ethereum futures ETFs to start trading next week

Investment firm Valkyrie will start offering exposure to Ether futures in the coming days. On Sept. 28, the firm told Cointelegraph that its Bitcoin Strategy ETF will allow investors access to Ether and Bitcoin futures “under one wrapper,” making it one of the first firms to do so amid several pending applications with the U.S. Securities and Exchange Commission. Starting Oct. 3, the fund’s name will be updated to the Valkyrie Bitcoin and Ether Strategy ETF. Asset manager VanEck also disclosed its upcoming Ethereum Strategy ETF, which will be listed on the Chicago Board Options Exchange in the coming days. Analysts suggested that a potential U.S. government shutdown might have accelerated the launch of Ether futures ETFs.

SBF trial dates revealed: FTX founder to stand trial over 6 weeks

Former FTX CEO Sam “SBF” Bankman-Fried will spend at least 21 days in court as part of his criminal trial, which will begin in earnest on Oct. 4 and last until Nov. 9, according to a newly released trial calendar posted to the public court docket. The first official date of the Bankman-Fried trial is Oct. 4, where the participants will begin discussing seven fraud charges laid against SBF. There are two substantive charges where the prosecution must convince a jury that Bankman-Fried committed the crime. Five other “conspiracy” charges involve the prosecution convincing a jury that Bankman-Fried planned to commit the crimes. The former FTX CEO has been serving pre-trial detention at the Brooklyn Metropolitan Detention Center since Aug. 11. If considered guilty of fraud, Bankman-Fried is likely to spend the rest of his life in prison, legal specialists explained to Cointelegraph.

3AC’s Su Zhu arrested in Singapore

Co-founder of Three Arrows Capital (3AC) Su Zhu was detained at Changi Airport in Singapore while trying to leave. Teneo, the joint liquidator of the now-bankrupt hedge fund, told Cointelegraph that Zhu’s arrest followed a committal order from the Singapore Courts, which is a directive used to imprison someone for contempt of court. On Sept. 25, Teneo secured this committal order, alleging that Zhu didn’t comply with a court order. His arrest is part of an ongoing investigation to retrieve funds for 3AC’s creditors. The $10 billion hedge fund crashed in 2022 due to the collapse of the Terra ecosystem. A similar committal order was granted against Kyle Davies, also co-founder of 3AC. His whereabouts remain unknown.

Binance urges users to convert euros to USDT after Paysafe debank

Binance has warned its European users to convert their euro (EUR) balances to Tether by Oct. 31 due to the loss of support from its banking partner, Paysafe. Paysafe ceased processing EUR deposits for Binance users on Sept. 25. While EUR withdrawals to bank accounts remain available, Paysafe users won’t be able to engage in EUR spot trading. Binance’s token swap feature, Binance Convert, will also restrict EUR transactions. Paysafe previously facilitated fiat deposits and withdrawals for Binance users in Europe, including via bank transfer in the European Union’s Single Euro Payments Area. The move is the latest to add to Binance’s regulatory and debanking woes in the West.

SEC delays spot Bitcoin ETF decision for BlackRock, Invesco and Bitwise

The U.S. Securities and Exchange Commission has again postponed its decision on several spot Bitcoin ETF applications, including those from BlackRock, Invesco, Bitwise and Valkyrie, ahead of a potential government shutdown. Bloomberg ETF analyst James Seyffart anticipates similar delays for Fidelity, VanEck, and WisdomTree. These delays came two weeks before the applicants’ expected second deadline. Seyffart links the premature delays to an anticipated U.S. government shutdown on Oct. 1, which would impact financial regulators and federal agencies.

Winners and Losers

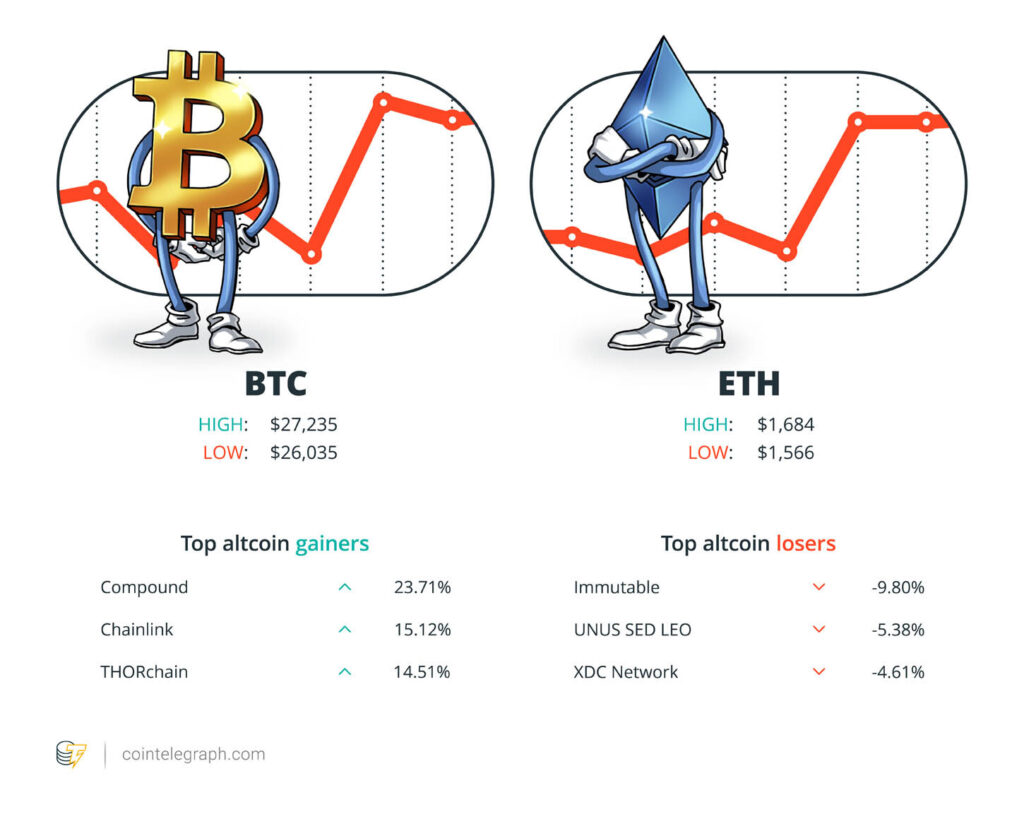

At the end of the week, Bitcoin (BTC) is at $26,895, Ether (ETH) at $1,667 and XRP at $0.53. The total market cap is at $1.07 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Compound (COMP) at 23.71%, Chainlink (LINK) at 15.12% and THORchain (RUNE) at 14.51%.

The top three altcoin losers of the week are Immutable (IMX) at -9.80%, UNUS SED LEO (LEO) at -5.38% and XDC Network (XDC) at -4.61%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Read also

Features

Inside South Korea’s wild plan to dominate the metaverse

Features

Unstablecoins: Depegging, bank runs and other risks loom

Most Memorable Quotations

“You [Gary Gensler] are kneecapping the U.S. capital markets with the avalanche of red tape coming out of your commission.”

Andy Barr, U.S. representative

“A central bank that introduces a CBDC should increase the choices for society, not diminish them.”

Agustín Carstens, general manager at the Bank of International Settlements

“Looking like the SEC is gonna let a bunch of #Ethereum futures ETFs go next week potentially.”

James Seyffart, analyst at Bloomberg Intelligence

“Do you think it’s possible for you [Gary Gensler] to serve as an impartial regulator and not favor large financial intermediaries?”

Tom Emmer, U.S. representative

“[Stablecoins] will be a big driver of economic freedom in the decade ahead.”

Jesse Pollak, head of protocols at Coinbase

“The symbiosis between street art and Bitcoin is a powerful one. By working together, these two movements help to create a more just and equitable world.”

Street, pseudonymous co-founder of the Street Cy₿er artist collective

Prediction of the Week

Bitcoin shorts keep burning as BTC price seeks to hold $27K

Bitcoin (BTC) bounced around $27,000 on Sept. 29 as a challenge to month-to-date highs dragged BTC price action upward. Data from Cointelegraph Markets Pro and TradingView showed the largest cryptocurrency attempting to hold gains after a classic “short squeeze.”

The day prior offered a trip past the $27,000 mark, with Bitcoin bulls unable to seal a fresh peak for September. Topping out at $27,300 on Bitstamp, BTC price strength returned to consolidate, still up 4% versus the week’s low at the time of writing.

Analyzing the situation on low timeframes (LTFs), popular pseudonymous trader Skew said that the upside had come courtesy of derivatives markets, with spot traders selling at the highs. “LTF stuff but pretty clear spot absorption around the high so $27.2K is an important price area to clear for spot buyers,” he explained on X (formerly Twitter).

Skew subsequently noted that $27,200 remained a rejection point on the day, ahead of the Wall Street open. Going into next week, he added, the market was “likely to hunt both sides of the book.”

FUD of the Week

Ben ‘BitBoy’ Armstrong arrested on livestream over Lambo dispute

Crypto influencer Ben Armstrong, formerly known as “BitBoy,” was arrested on Sept. 25 while livestreaming outside a former business associate’s house, claiming the associate had his Lamborghini. He was charged with “loitering/prowling” and “simple assault by placing another in fear” and was held for over eight hours before being released on a $2,600 bond and $40 in fees. In Georgia, the misdemeanor charges of loitering and prowling could result in a fine of up to $1,000, up to one year in jail, or both.

Crypto exchange claiming $1.4B trading volume uses reportedly fake license data

An investigation by Cointelegraph revealed that several cryptocurrency platforms, reporting significant daily trades on CoinMarketCap, may have provided misleading information about their crypto licenses. Bitspay, for instance, which has a daily trading volume of $1.4 billion on CoinMarketCap and ranks as the fourth-largest crypto exchange, claimed to be licensed in Estonia. However, after inquiries by Cointelegraph, Bitspay quickly removed the potentially false license data and no longer provides details about its registration or licensing.

Huobi Global hacked for $7.9M: Report

Huobi Global’s HTX crypto exchange was hacked on Sept. 24, according to a report from blockchain analytics platform CyVers. A total of $7.9 million of crypto has been drained in the attack. A known Huobi hot wallet posted a message to the attacker in Chinese. According to the message, the exchange knows the identity of the attacker and has offered to let them keep 5% of the drained funds as a “white-hat bonus,” but only if the attacker returns the remaining 95%. Binance CEO Changpeng “CZ” Zhao offered the help of the exchange’s security team in investigating the attack.

Blockchain detectives: Mt. Gox collapse saw birth of Chainalysis

From solving Mt. Gox to tracing crypto used by child abuse syndicates in Korea, Chainalysis has a long but sometimes controversial history.

US gov’t messed up my $250K Bitcoin price prediction: Tim Draper, Hall of Flame

Tim Draper’s first big Bitcoin prediction came off without a hitch, but he says the current administration is making his second one look bad.

China dev fined 3 yrs’ salary for VPN use, 10M e-CNY airdrop: Asia Express

Chinese national fined three years’ salary for using VPN for remote work, Hangzhou airdrops 10M digital yuan, JPEX alleged Ponzi nears $200M, and more.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.