On-chain data from Glassnode show Bitcoin’s (BTC) movements hit a new record for the largest net decline in aggregate BTC balances on exchanges, reducing by 72,900 BTC in one week.

A similar movement occurred in April 2020, November 2020 and June 2022 with the current outflow leaving around 2.25 million BTC on exchanges.

Exchange exodus for Ether, but not stablecoins

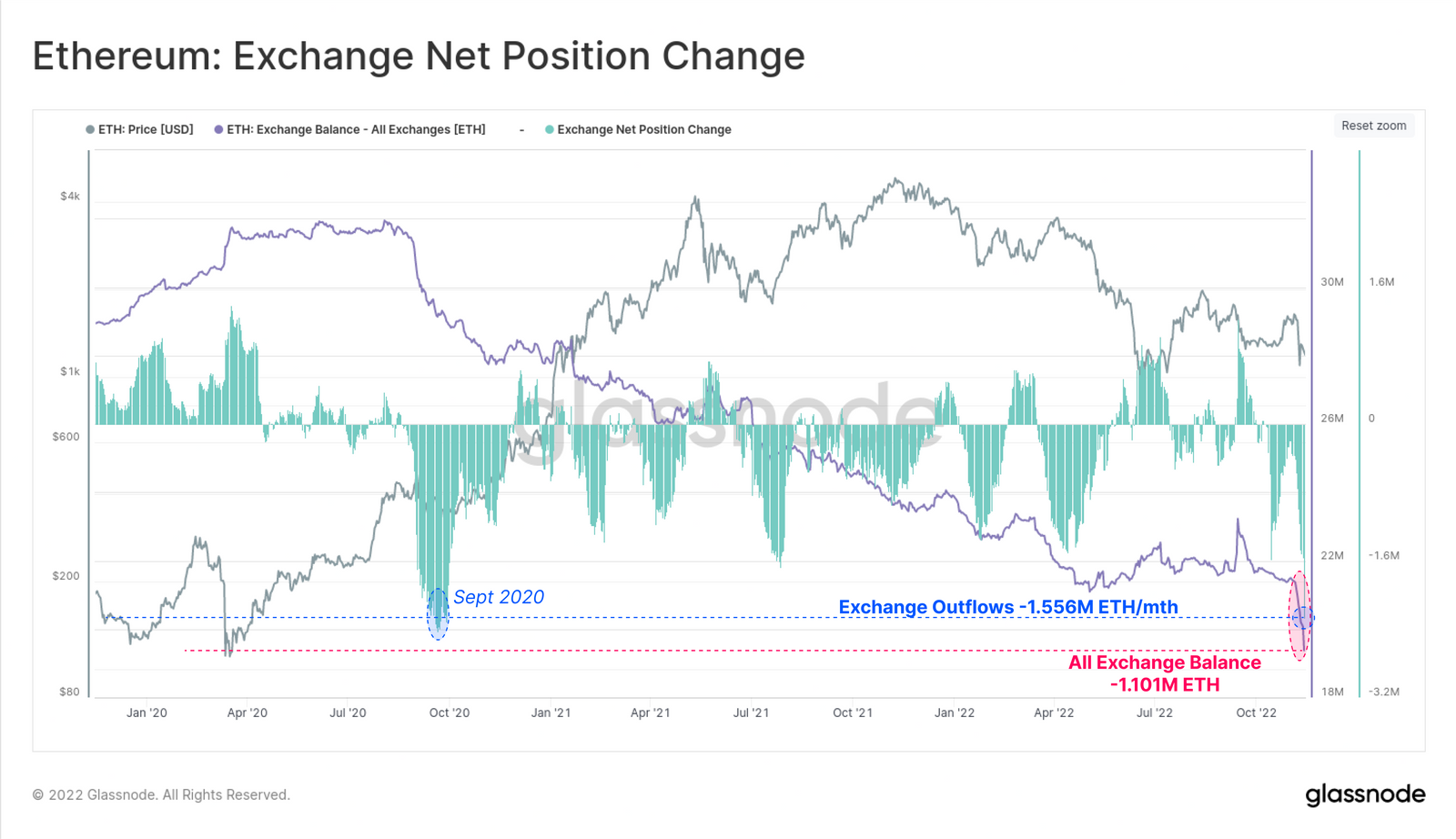

While Ether (ETH) did not see an all-time high outflow from exchanges, 1.1 million Ether were withdrawn from exchanges over the last week. According to Glassnode, this marks the largest 30-day exchange balance decline since September 2020 during the DeFi summer in the same year.

Related: Exchange outflows hit historic highs as Bitcoin investors self-custody

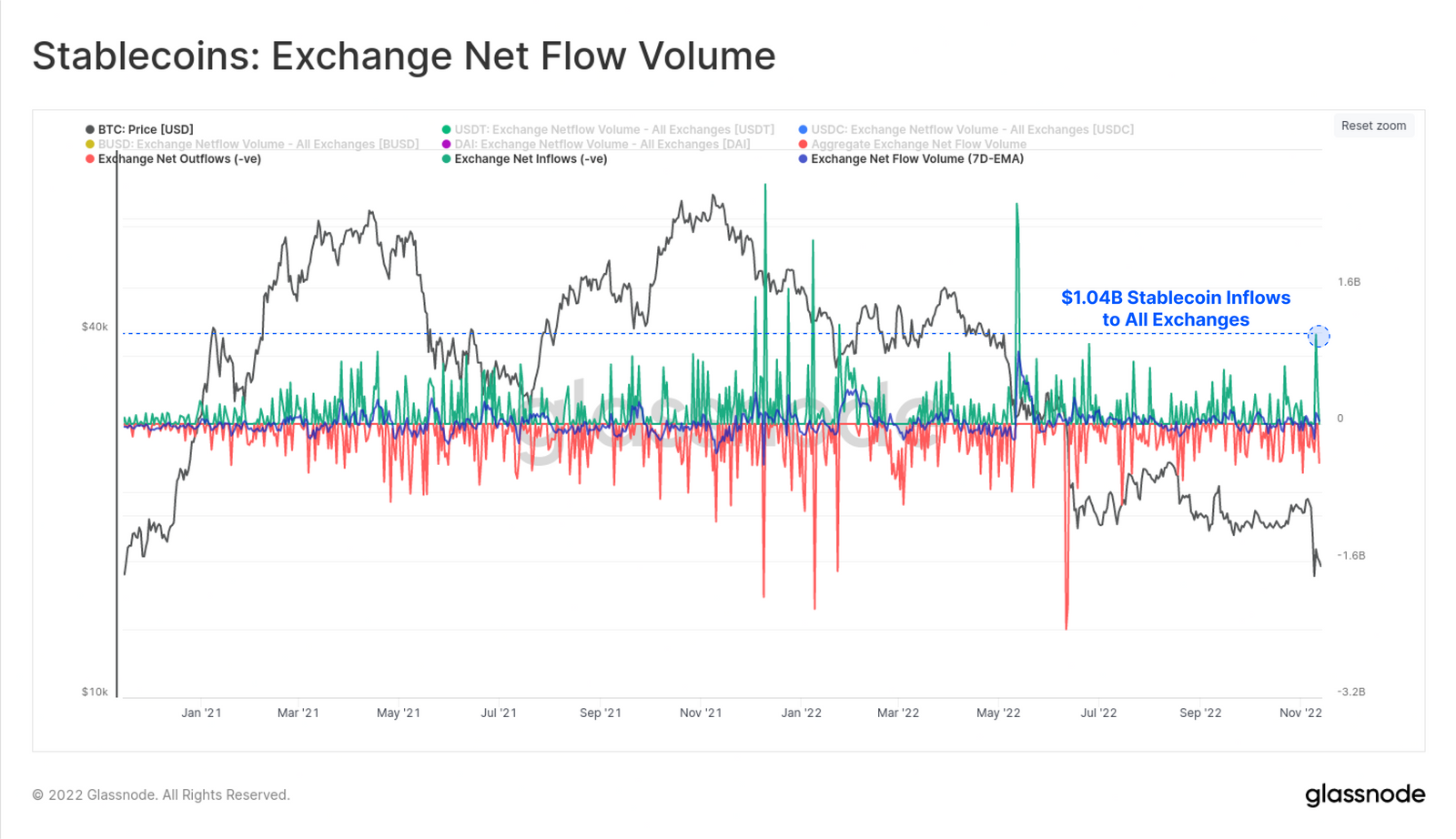

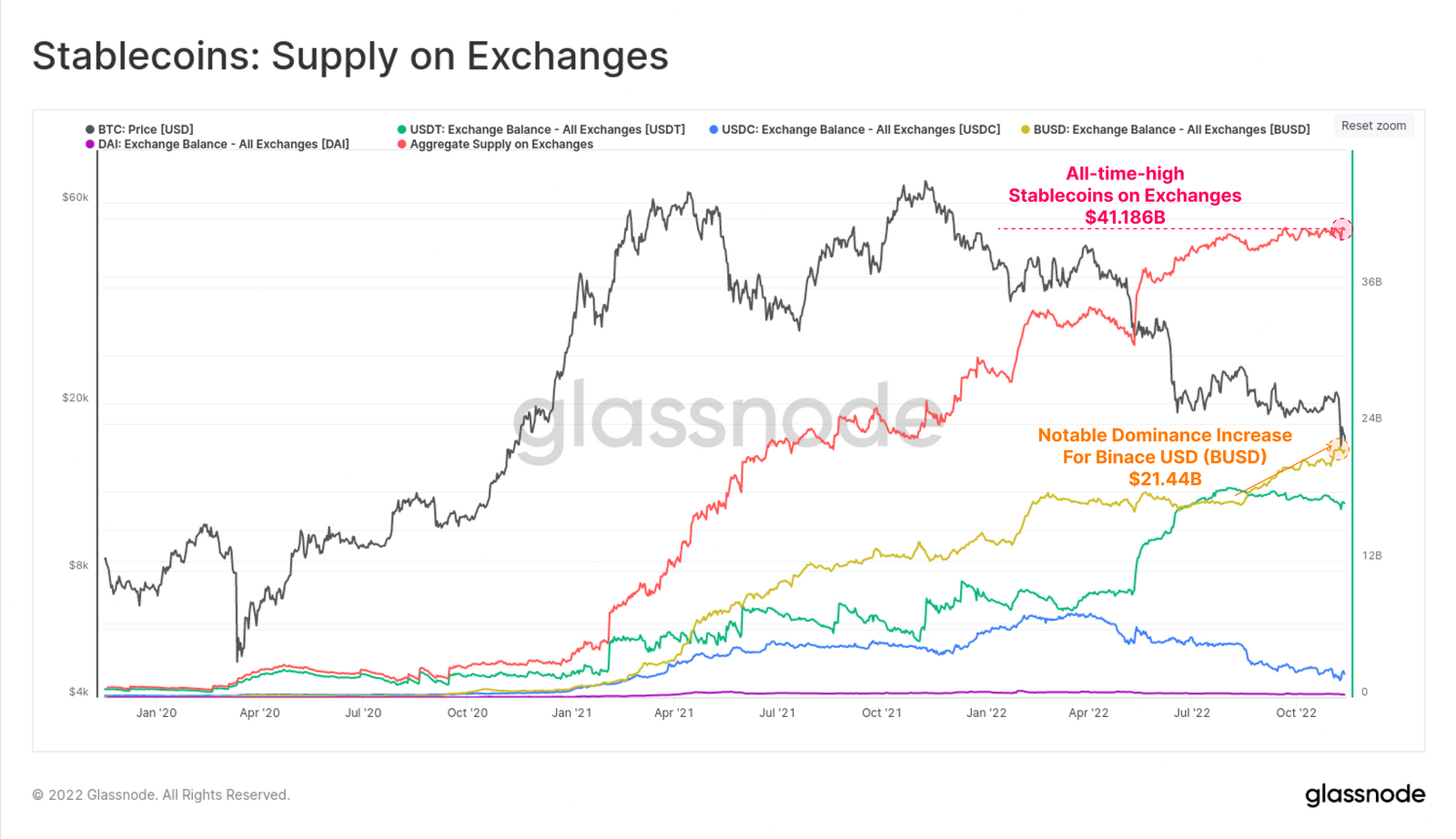

Contrary to Bitcoin and Ether’s declining balances on exchanges, stablecoins balances remain net positive on exchanges, meaning their balances are growing. Over $1.04 billion in USDT, USDC, BUSD and DAI moved to exchanges on Nov. 10. This marks Nov. 10 as the seventh largest stablecoin inflow to exchanges.

According to Glassnode, with the major influx of stablecoins to exchanges, the current $41.186 billion total is an all-time high.

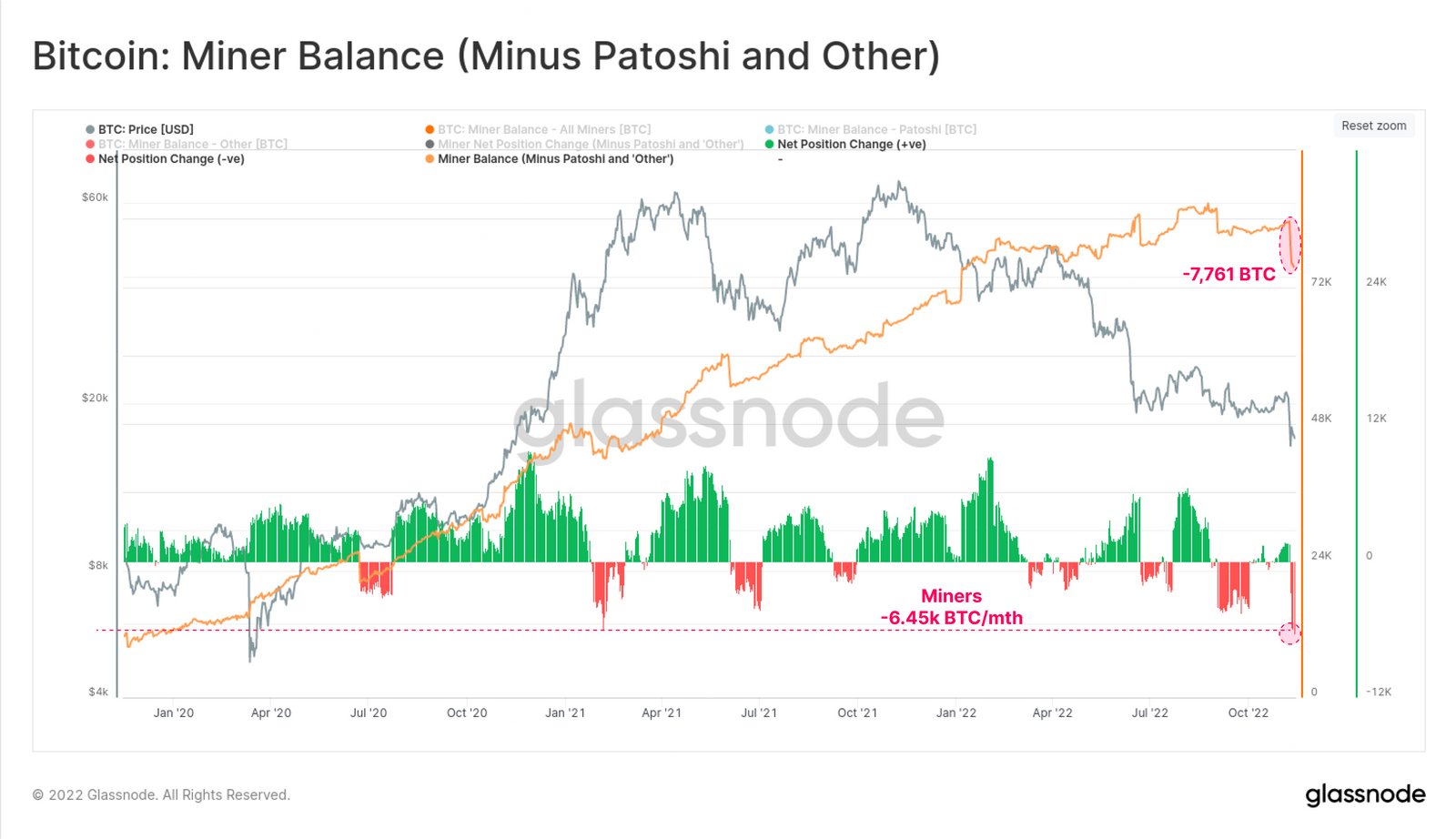

Bitcoin miners continue to sell

Bitcoin miners continue to remain under extreme pressure and data highlights that hash prices are at all-time lows. The record-low hash prices led to miners selling around 9.5% of their treasuries which is around 7.76 million BTC. This sell-off marks the sharpest monthly decline for miner balances since September 2018.

Decentralized and centralized altcoin performance

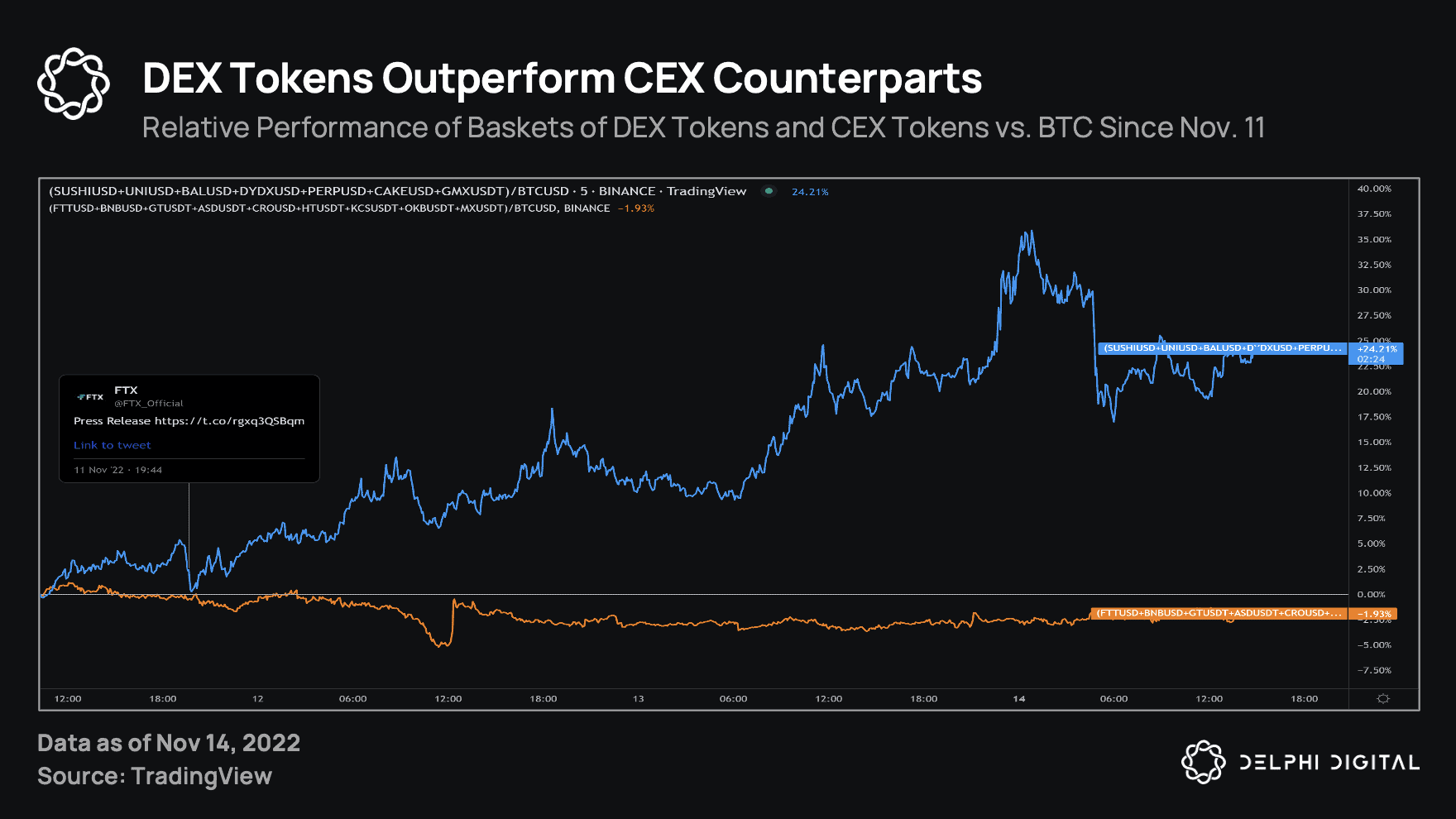

Utilizing asset basked to analyze performance between decentralized exchange (DEX) and centralized exchange (CEX) tokens, Delphi digital found that when comparing the basket prices to BTC, the DEX basket had gained 24% whereas the CEX basket is down 2%.

Generally, the on-chain activity correlates to overall Bitcoin, Ether and altcoin market sentiment with the current FTX chaos catalyzing historic exchange outflows and CEX tokens’ underperformance. A likely trend to emerge from the current chaos is a steady uptick in self-custodied cryptocurrencies and an increase in DEX use.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.