Dollar-pegged stablecoins are not immune to dropping their pegs, but some such as Circle’s USD Coin (USDC) and MakerDAO’s Dai (DAI), have been more prone to depegging than others, according to analysts at S&P Global.

A September research paper from Dr. Cristina Polizu, Anoop Garg and Miguel de la Mata, delved into stablecoin valuation and depegging for five leading stablecoins: Tether (USDT), Binance USD (BUSD), Paxos (USDP), USDC and DAI.

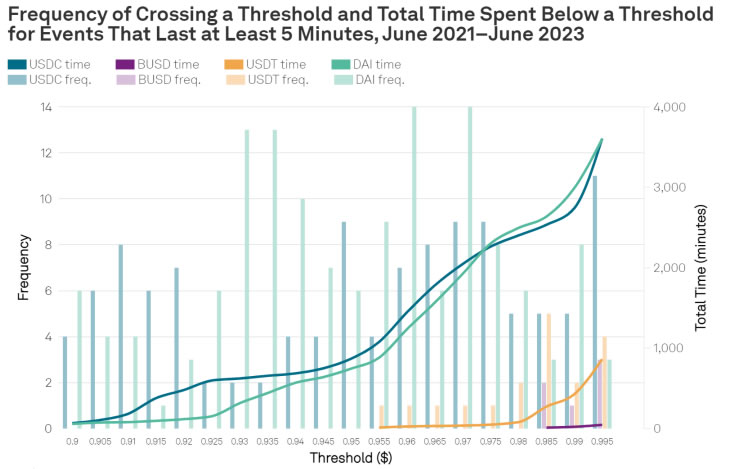

The analysis revealed that USDC and DAI have spent more time below a dollar than USDT and BUSD over the past two years. In the longest and deepest de-peg event, USDC was below $0.90 for 23 minutes and DAI for 20 minutes.

However, USDT dipped below $0.95 for only one minute, while the price for BUSD did not drop below $0.975 at all between June 2021 and June 2023.

Moreover, the frequencies of de-pegging were far higher for USDC and DAI than USDT and BUSD over the two-year period.

The researchers noted that one-minute de-peg events “can be attributed to noise,” especially for thresholds closer to $1. Longer de-peg events were considered “more meaningful” but the results still favored USDT over USDC.

USDC dropped to $0.87 in March 2023 in connection with the Silicon Valley Bank collapse. USDC issuer Circle had $3.3 billion of its $40 billion USDC reserves at the time with SVB.

MakerDAO was one of the largest holders of the stablecoin at the time, with over 3.1 billion USDC in reserves collateralizing DAI which also de-pegged.

“Maintaining the peg and a stabilization mechanism requires good governance, adequate collateral and reserves alongside liquidity, market confidence and adoption,” Dr. Polizu and colleagues concluded.

Related: PayPal’s stablecoin opens door for crypto adoption in traditional finance

Tether has been plagued with mainstream media FUD for years, yet the findings suggest USDT has been more stable than its rival USDC over the same period.

Moreover, the supply of USDT has increased by 25% since the beginning of the year to 83 billion, giving it a commanding stablecoin market share of 67%. This has largely been at the expense of Circle, which has seen USDC supply shrink by 41.5% and market share fall to 21% over the same period.

Magazine: Magazine: Recursive inscriptions — Bitcoin ‘supercomputer’ and BTC DeFi coming soon

Leave feedback about this