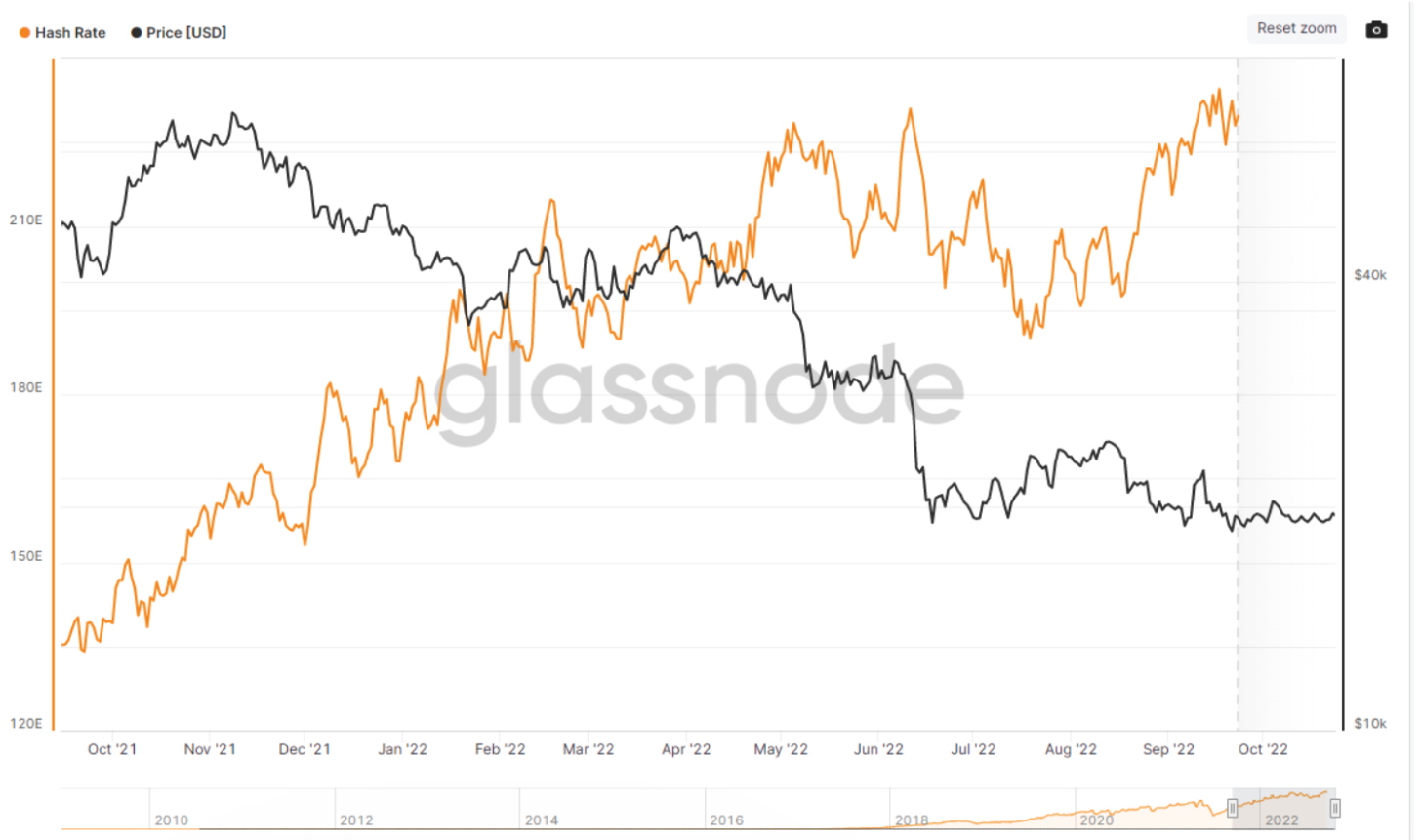

October witnessed a surge in Bitcoin’s (BTC) hash rate which is pushing the metric to a new high of 245 Exahashes per second. These changes led to a sharp decrease in the hash price, resulting in a drop in the profit margins for BTC miners reaching a low of $66.8 USD/PH (per one quadrillion hashes per second) on Oct. 24, 2022.

According to Luxor Technologies, “hashprice” is the revenue BTC miners earn per unit of hash rate, which is the total computational power deployed by miners processing transactions on a proof-of-work network.

Not only has volume been inconsistent, the Bitcoin hash rate increased last week to an average of 269 EH/s. This means the difficult hash rate has been rising since July 2022.

Several factors, including expansion of mining operations, which creates miner competitiveness, increased use of ASIC miners which are more efficient than their alternatives and the Ethereum Merge led to some Ethereum (ETH) mining firms to fill empty rack space from non-operating ETH GPU mining with BTC specific ASIC miners.

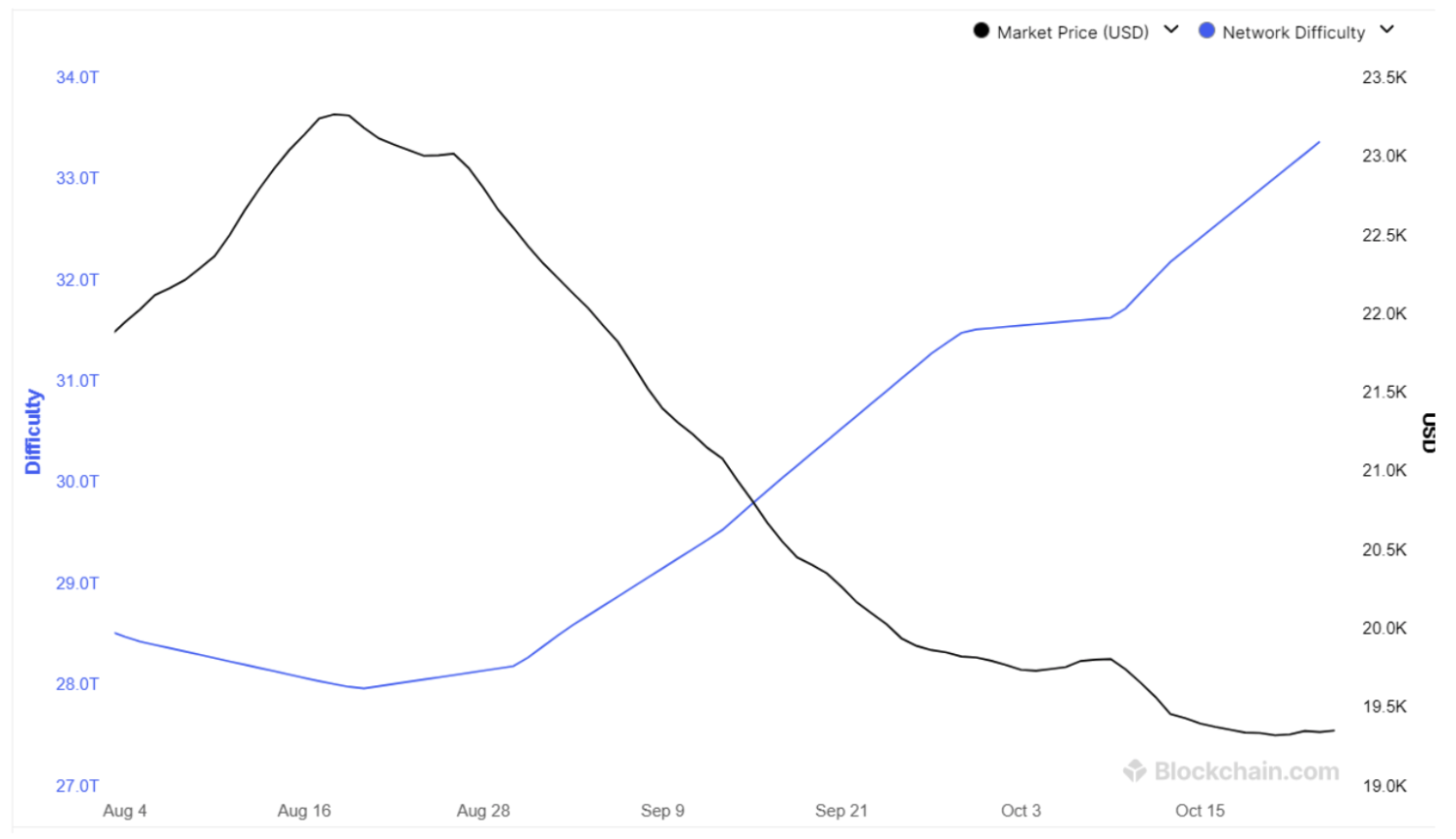

Consequently, the surge in the hash rate resulted in an adjustment of the Bitcoin difficulty at a time when BTC’s price was dropping. As expected, after the spike of the hash rate and the increase in the Bitcoin difficulty, the hash price plummeted to $0.0657 tera hash per day, thereby reducing the level of profit.

Increase in mining costs translates to compressed profits

A contributing factor to the depressed profit level is the general rise in BTC mining costs. For example, there has been a sharp increase in the price of electricity in the U.S. From July 2021 to July 2022 alone, its price increased by 25%, from $75.20 to $94.30 per megawatt hour. Energy prices also tend to increase in winter as people need to heat their homes. The Bitcoin mining industry is already seeing a rise of mining in Kazakhstan due to affordable energy.

Bitcoin miners face other rising costs such as the hosting fee, acquisition of miners and installing or upgrading of the cooling systems. During the 2020 to 2021 crypto bull market, Bitcoin mining companies took out loans when BTC and equipment prices were also much higher. This means that the interest on existing debts themselves could hurt newer and overleveraged mining firms.

It is clear that the increase in hash rate and Bitcoin difficulty, as well as the decrease in hash price leads to a compressed profit margins. The following graph shows a decrease in profits in a landscape where hash rate, difficulty and the cost of electricity continue to rise.

If the hash rate continues to increase amid a falling hashprice, the profit margin will continue to decrease, possibly leading some mining firms to close up shop permanently.

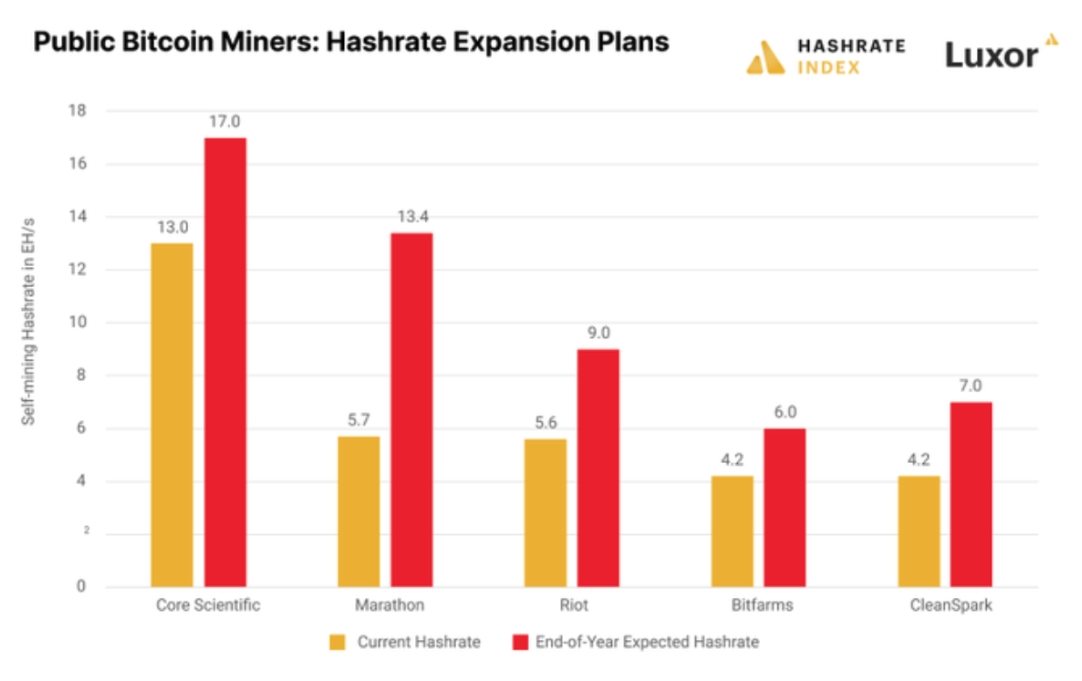

One possible outcome is that lean (cooler balance sheets) mining firms like Marathon may be able to purchase liquidated equipment and rack space from bloated mining companies that fail.

Mining firms that are staying lean while attempting to scale may prove victorious. Mining companies such as Core Scientific, Marathon, Riot, Bitfarm and CleanSpark are preparing for expansion even as many miners are finding profitability difficult.

Related: Public Bitcoin miners’ hash rate is booming — but is it actually bearish for BTC price?

Is sustainability the answer?

In view of the difficulties discussed, BTC mining firms should adopt sustainable BTC mining models for both profitability potential and to ease regulators. This should include using renewable energy sources, increasing production capacity and installing advanced cooling systems.

Mining firms can enhance their operations by using renewable energy from wind power, solar power and hydro which concurrently reduces costs and the carbon footprint. This approach can lead to more consistency and sustainability in Bitcoin mining energy costs. Norway has managed to capture 1% of all Bitcoin mining through a 100% renewable energy approach.

The depressed Bitcoin price, high hash rate and Bitcoin difficulty as well as low hash price contribute to small profit margins which may lead to sustainable, decentralized mining practices across the industry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.