Welcome to Metaverse Market Analysis! Every Monday we bring you the latest stats and data on the overall state of the metaverse market, and this week’s article is our monthly metaverse market overview. This column is in partnership with the incredible team from OneLand, a financial platform for virtual lands in the metaverse.

Highlights:

- Metaverse real estate endures a tough August, as blue-chip projects suffer big declines in land caps and token prices slump

- The Sandbox launches Alpha Season #3 over 10 weeks, hoping for a land sales recovery

- Decentraland sees no exit from the bear market

- Worldwide Webb flexes its muscles with a new NFT integration tool and partnerships galore

Market Data & Analysis

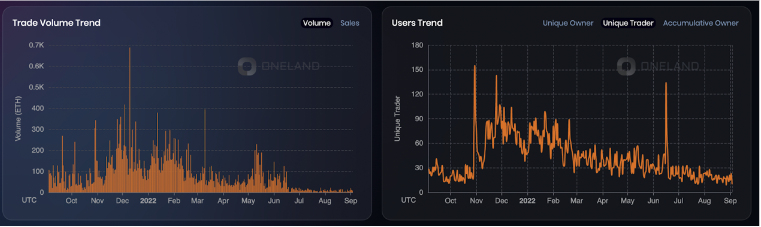

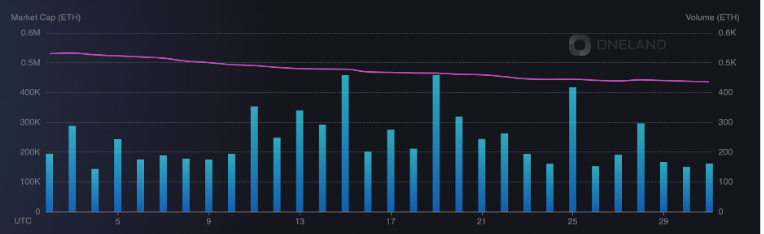

Things did not bode well for the virtual worlds economies in August, with the aggregate land cap of all 7 metaverse projects listed on OneLand (The Sandbox, Decentraland, Voxels, Somnium Space, WorldwideWebb, NFT Worlds and Otherside) declining 15.85% to 888,309 ETH, or $1.378 billion.

It represents a marked downturn from July’s decline of 9.9%, and an inversion of the global NFT market monthly result. Besides, it marks the first time the total land cap of the 7 projects has sunk below 1 million ETH since Otherside first entered the fray on May 1.

The bulk of the downturn, far worse in percentage terms than the crypto August performance, obviously results from blue-chip projects Otherside (-18.2%), The Sandbox (-18.6%) and Decentraland (-8.3%), none of which had good months. However, all 7 projects suffered declines in land caps, while only Voxels and WorldwideWebb saw increases in trading activity.

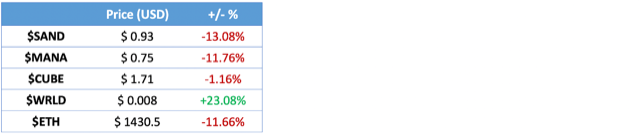

The price of ETH falling 8.15%, in contrast to July’s 54% boom, may have contributed somewhat to the result. In line with the downtrend, the Metaverse Index tumbled 26% to end the month at $34.

Metaverse Projects

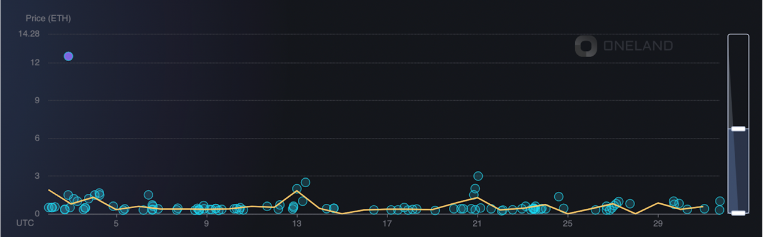

The Sandbox

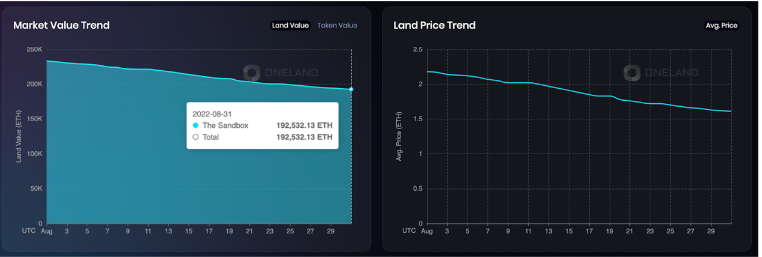

Trading volume for LANDs in The Sandbox continued to dive in August, down 40.6% on the back of a 30% drop in July. The average price of a parcel toppled (-29.4%) to end the month at a lowly 1.61 ETH, putting downward pressure on land cap which fell 18.6% to below 200,000 ETH for the first time since November. True – that was during a meteoric rise for The Sandbox, when the price of $ETH was triple what it is now, yet it only makes the comparison more telling.

Aug 24 saw the launch of Alpha Season 3, the longest, biggest and most accessible of all Alpha Seasons to date. As described in last week’s wrap-up, it will be very interesting to see the impact it has on the LANDs trade, given this Season lasts a full 10 weeks and comes deep in a bear market.

While there was no pickup in sales in its first week, the last few days of August saw some of the highest price sales in The Sandbox in a month, including one LAND for 19.98 ETH. Unique holders have also been on the up since Season launch, which may signify a turnaround from its June-to-mid-August decline.

Decentraland

There was no hiatus in sight in August from Decentraland’s bear market slide. Its land cap continues to suffer, falling another 8.3% to 183,175 ETH, below half of what it was at its last peak in June. Another monthly fall in volume (-16.5%) on the heels of July’s 80% plummet does no look healthy for Decentraland’s economy.

Though the sales count remained on par with July, both months failed to record a single day of volume over 22 ETH; in comparison, this was a daily constant in June, which had a top trading day of 145 ETH.

While July recorded top sales of 50, 44, 33, 25, 19 and 12 ETH, August’s top sale was a mere 11.39 ETH (for an Estate). Besides, it came as a 2-month rally in MANA’s price collapsed in the second half of August to end the month 24.5% lower than it began it.

Numbers of unique land holders continue to rise, MoM and WoW. Yet it is becoming more difficult to ascertain if this represents steadfast belief from the community, cheap parcel prices, or a growing number of liquidations by the more cash-strapped. Events such as the third edition of Decentraland’s Art Week are currently not driving any big increases in foot traffic nor a resurgence in property sales.

Voxels

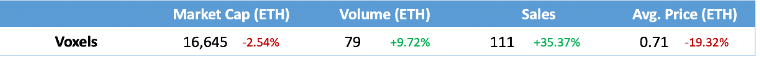

A top sale of 12.5 ETH on Aug 2 was just enough to see a 9.7% rise in trading volume for Voxels, but nothing else too positive. Sales were up for the month, but the average price fell 30% for a second month in a row, sending its market cap south another 2.54% to just 16,645 ETH, a number it last saw in November.

July’s decision to lay off staff and focus on its core product – putting a pause on promotions, partnerships and new land mints – did bear some fruit in August with the team releasing a series of tech updates. Still, neither a decision to reduce its land cap, nor the Burn Party they held to showcase it, will be seeing Voxels lift its head very far above the waterline just yet. Gifting a bunch of $FOLK to around 12,000 wallets cannot hurt though. In the meantime, the number of unique landholders keep rising, up another 2% for the month.

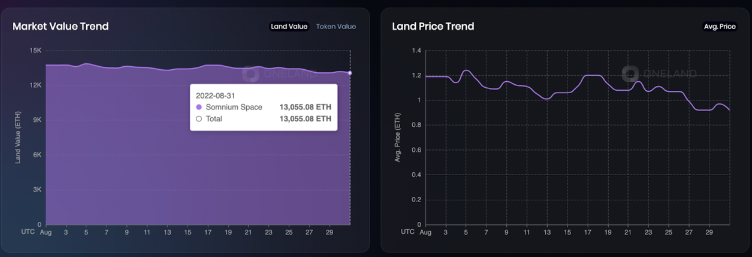

Somnium Space

Somnium Space experienced a comedown in August on the back of a very eventful July. Perhaps founder Artur Sychov’s launch of his new Web3 social media platform Authencity on Aug 19 took some of his and others’ attention away from his metaverse (something he was compelled to deny on Twitter), as land sales dropped off following the announcement.

Overall, it was not a great month for the metaverse, as trading volume sunk 89% from 68 to just 38 ETH. With a 33% drop in sales count, and a 15% retreat in average price, Somnium’s land cap finished the month down 4.1%.

Somnium’s economy has suffered the bear market on the back of its native token CUBE crashing 93% from its ATH of $24.93 in February to where it sits today below $2. A 40% price bump in the first week of August was short-lived, as the price came down through the rest of the month (+9.1%). In terms of ETH, Somnium’s land cap came crashing down in March-April and has remained in the 13,000-14,000 ETH zone ever since.

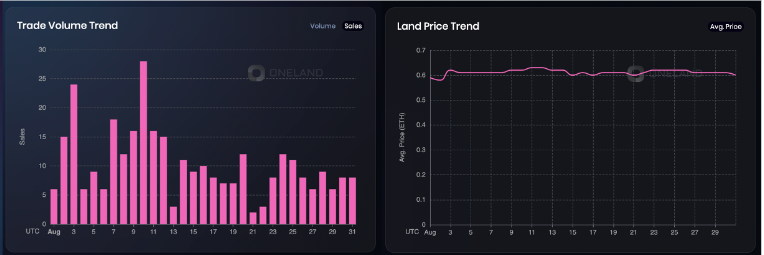

WorldwideWebb

Our intimation that the team were hard at work in July seems to have been right, as in August WorldwideWebb released a string of updates including a new integration tool they say will increase the “1 million+” NFTs already integrated in the project. In the past month, NFTs from Meetbits, Moonbirds, Staycool, Dead Fellaz, The Doge Pound, Dippies and Picaroons, as well as POAPs, were all added to the 2D virtual world. WorldwideWebb also released news of partnerships with Immutable X and GameStop.

The good news obviously impacted trading activity, as sales numbers and volumes rebounded from July, particularly in the first half of the month. The highlight, of course, was a big 25 ETH sale that changed the mood on Aug 3, given the last sale nearing this magnitude was one for 17.97 ETH back in May.

Nothing came close after this, with premium sales a very rare event of late for all projects, save perhaps Otherside. WorldwideWebb’s land cap still suffered a small 1.36% downturn, while land holders continued to gradually decline, down another 0.55% for the month.

NFT Worlds

No economic recovery is yet in sight for NFT Worlds since Minecraft’s ban on NFTs, though signs are at least emerging that the team have been hard at work after promising a new platform and releasing a new tokenomics paper at the end of July.

The last week of August saw the team launch a new dev channel in its Discord and fill it with a bunch of updates, while also informing the public they would maintain Minecraft content to ensure a seamless transition to the new game.

Overall, all metrics appeared in red for NFT Worlds in August, with trading volume (-78%) and sales (-64%) dropping significantly once the major sell-off calmed down and the average price crashed well below 1 ETH. NFT Worlds’ land cap dropped by 19.8% in August to 34,184 ETH – a 57% decline from May and 29% decline from July 20 when Minecraft banned NFTs.

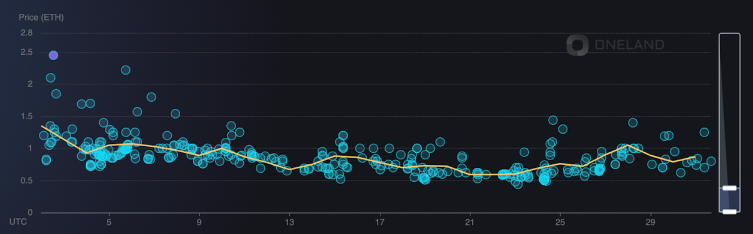

Otherside

Otherside’s total land cap sunk 18.2% this month to round out the month at 435,733 ETH, dropping below half a million ETH for its first time. Following a 22% increase in its average ETH price in July (a month in which ETH rose 54%) things corrected this month, as trading activity had a significant drop. Top sales of prized Otherdeeds have been dropping off of late, with August seeing just 3 sales above 50 ETH, down from 5 in July and over 10 in June.

Regardless, these prices plus Otherside’s 2,064 sales (-20.5%) and 7,334 ETH of volume (-45.1%) not only dwarfed all other projects, but were enough to see all-time sales of Otherdeeds hit an incredible $1.035 billion and, in doing so, bypass NBA Top Shot to record the largest NFT sales volume of all time. Achieving such a result in its short 4-month history in the midst of a crypto winter not only showcases the capital and might of Yuga Labs, but the pulling power of the Metaverse itself.

Follow OneLand >> Twitter

Stay up to date with the hottest metaverse news >> Here

Want more?

*All investment/financial opinions expressed by us are from the personal research and experience of our site moderators and are intended as educational material only. Individuals are required to fully research any product prior to making any kind of investment.