Welcome to Metaverse Market Analysis! Every Monday we bring you the latest stats and data on the overall state of the Metaverse market. This column is in partnership with the incredible team from OneLand, a financial platform for virtual lands in the Metaverse. This week brings the OneLand Metaverse Market Analysis stats for July 3 – 9, 2023.

Stake your TheSandbox LAND & earn 3.94%* APY. Stake your $SAND & earn 11.83%* APY (*7.10.2023)

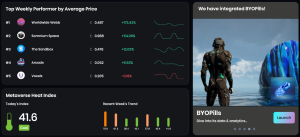

OneLand 7-day data shows total land cap for the 10 projects listed down 1.13% to 696,406 ETH ($1.297bn, -4.93%). ETH slumped 3.85%. It reflected the overall state of NFTs, -4.3% in overall USD market cap.

As usual, Otherside – with its mass dominance over sales and trading volumes – was the prime suspect (-2.15%). This week the total land cap of all Otherdeeds hit its lowest ever, ending the week down 37% from launch.

Meanwhile, a flurry of sales in recent months at The Sandbox has not been making any positive impact on its overall LANDs cap, now on a 6th straight week of decline (-1.68%) ahead of its Infinite Pulse LAND sale.

On the other hand, land caps remain relatively stable across Treeverse, Somnium Space and Worldwide Webb, while that of TOPIA Worlds Worlds hit its highest (+2.54% to 16,348 ETH) since its migration over from former project NFT Worlds.

Highlight: Treeverse

It was a second consecutive week of rising trading activity at Treeverse, with sales of plots bumping another 10.45% (30D sales +111%). However, this metric came at the expense of prices dropping and a lowest weekly top sale since mid-May.

Still, if sales numbers and trading activity are any indication, signs are momentum could be building at Treeverse. The last 30D have witnessed unique holder numbers on an upward trajectory for the first time in a year, while even holding concentration shows a more even spread.

For explanations of our data calculations, check docs.oneland.world/. For metaverse market and project data, check oneland.world.

—

OneLand is a MetaHub, providing Metaverse data & analytics, Land NFT marketplace, LandFi tools and Metaverse MediaHub. Our mission is to make it easy to discover, access, stay tuned to, research and invest in the metaverse projects you love most.

https://oneland.world

Connect with us on Twitter

Want more?

*All investment/financial opinions expressed by us are from the personal research and experience of our site moderators and are intended as educational material only. Individuals are required to fully research any product prior to making any kind of investment.