With inflation well above 2% and a strong labor market, the US Federal Reserve (Fed) said it expects it will soon be appropriate to raise the target range for the federal funds rate. The Fed also decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March.

Notably, the new statement omitted some key details that were there in the last statement, including a mention of the Fed being “committed to using its full range of tools to support the US economy.”

Fed also noted that it would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of its goals.

Asked about the currently high inflation in the US during the press conference following the release of the statement, Fed Chair Jerome Powell admitted that “inflation has persisted longer than we thought.” We will use our tools to ensure higher inflation “does not become entrenched,” Powell said, adding that the Fed might raise rates in March.

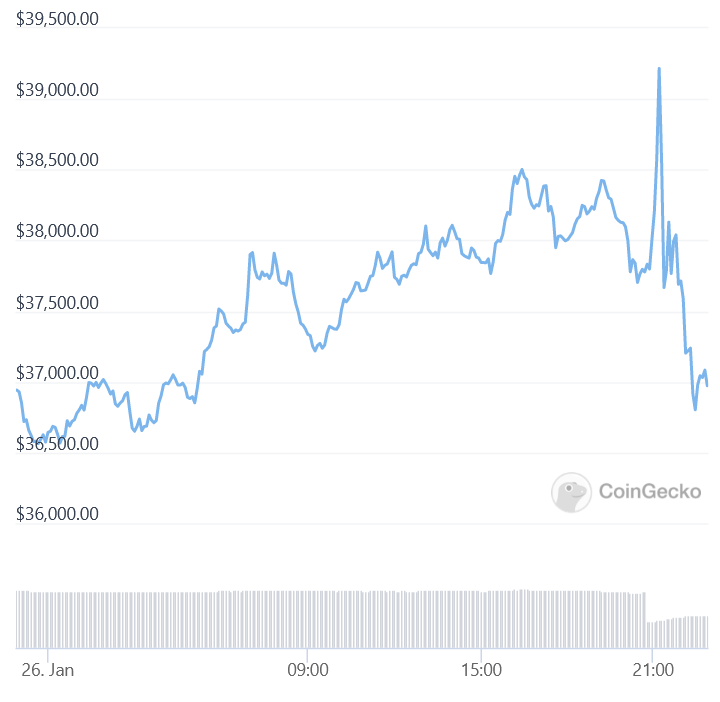

Meanwhile, after rallying right after the statement, both bitcoin (BTC) and ethereum (ETH) dropped sharply soon after.

At 20:50 UTC, BTC traded at USD 37,112 and was unchanged in a day, while ETH stood at USD 2,505 and was up 2% in a day.

BTC price chart:

Meanwhile, at 20:45 UTC, the technology-heavy Nasdaq stock index was down by 3.34% and the S&P 500 index lost 2.1% since the release of the statement.

Commenting on the Fed’s statement, Wells Fargo rates strategist Michael Schumacher called it “innocuous,” adding that “people are taking this as a pretty middle-of-the-road statement, not a lot to digest,” CNBC reported.

“The stock market is especially vulnerable to higher rates and the removal of the tailwind that the Fed’s asset purchases have provided for the past two years,” Chris Zaccarelli, Chief Investment Officer for Independent Advisor Alliance, said, per Bloomberg. According to him, while the economy will stay out of recession and the bull market in stocks will continue this year, the volatility might increase in the months ahead.

Ahead of the release today, analysts expected that the Fed would confirm that interest rate hikes will start in March this year.

“We see the Fed building towards a March hike, but at the same time creating flexibility,” the European financial services firm Nordea wrote in a note ahead of today’s statement. It added that the statement “should dismiss” speculation about a 0.5% hike, and that it does not expect a faster pace of tapering to be announced.

“This could make for a brief market relief,” the bank wrote.

Commenting on how the market might react to the statement, George Selgin, an economist at the libertarian think-tank the Cato Institute, wrote on Twitter that he does not expect “modest” tapering to have a substantial impact at all.

“Tapering has become the latest market bugbear. Yet, in theory at least, unlike actual rate hikes, modest changes in the size of the Fed’s balance sheet, in either direction, shouldn’t have any substantial consequences,” Selgin said.

Meanwhile, others hinted that the market may not react so calmly to what the Fed has to say, with fund manager Steven Van Metre writing that getting inflation under control is now the most important task for the Fed, which necessarily means that any market reactions would be secondary.

“The President and Congress told [Fed chair Jerome Powell] to get inflation down, and he’s going to do it,” Van Metre said.

Commenting to the Wall Street Journal earlier today, Luca Paolini, Chief Strategist at Pictet Asset Management, said that all eyes are on the Fed today, adding that the tone of the press conference will be as important as the content of the statement.

“It’s more about the tone of the press conference. People may have an expectation that given the market turmoil and the geopolitical tensions, the Fed may tone down its rhetoric,” the strategist said.

Lastly, with crypto markets having already fallen significantly from the top last year, former BitMEX CEO Arthur Hayes wrote in a blog post on Tuesday that bitcoin appears tempting below USD 30,000, regardless of the tone of the Fed’s statement.

For BTC, a notable resistance level can be found around USD 28,500, while USD 1,700 will be an important level for ETH, the outspoken former CEO said.

“I don’t believe in a bottom until these levels are retested. If the level holds, amazing. This prong has been met. If it doesn’t, then I believe a mega liquidation candle will happen in the USD 20,000 to USD 28,500 range for BTC and the USD 1,300 to USD 1,700 range for ether,” Hayes predicted.

____

Reactions:

____

– How Global Economy Might Affect Bitcoin, Ethereum, and Crypto in 2022

– Bitcoin in an Interest Rate Rising Environment

– IMF Warns of Dangers of Fed’s Rate Rise, Brazil Says Inflation ‘Won’t Be Temporary in West’

– Two Main Macro Scenarios in Play for Bitcoin & Crypto in 2022 – CryptoCompare

– Bitcoin, Ethereum Could Benefit If Stocks Drop After Fed Tightening – Strategist

– Inflation Is the Biggest Test Yet for Central Bank Independence