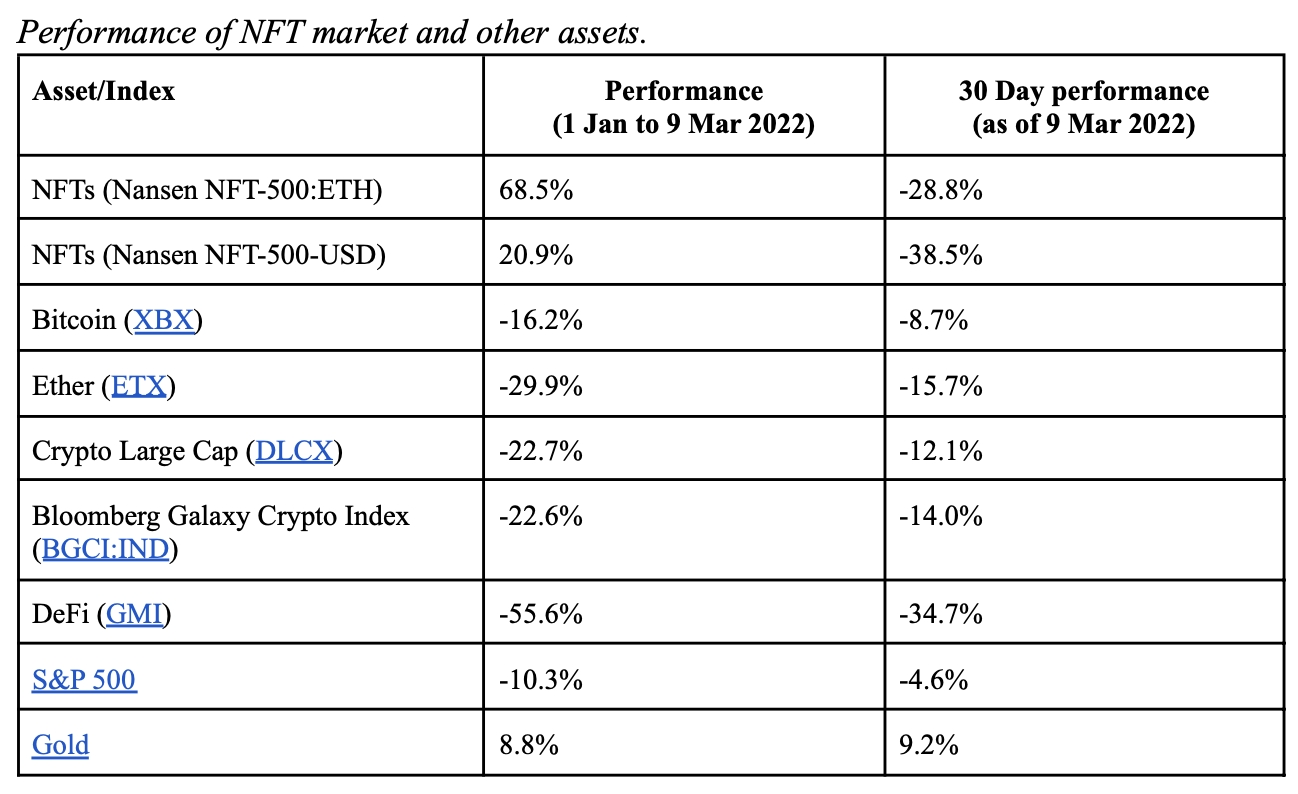

The market for non-fungible tokens (NFTs) has outperformed the broader crypto market this year both when measured in ethereum (ETH) and US dollar terms, according to the Ethereum-focused data analytics firm Nansen.

The year-to-date outperformance of the NFT market relative to the crypto market stands at 68.5% when denominated in ETH, and 20.9% when denominated in USD, their new report said. This shows that the NFT space has held up better than ETH, with crypto prices tumbling lower for the better part of the year.

Since the beginning of 2022, the price of ETH had fallen by 32% at the time of writing, while bitcoin (BTC) was down by 19% over the same period.

Also, according to the firm, the year-to-date performance of its Nansen NFT-500 (ETH) index shows that the NFT market has what is described as “a relatively weak correlation” with the crypto market when measured in US dollar terms.

Measured in ETH terms, however, the two markets are inversely correlated, the report added.

The Nansen NFT-500 index is one out of six NFT indexes created by Nansen since September 2021 to track performance across the NFT market.

“Index investing typically seeks to offer investors exposure to a market sector as opposed to picking winners,” Louisa Choe, Research Analyst at Nansen, told Cryptonews.com.

Drilling down to specific sectors of the NFT market, Nansen said that its Art-20 index shows that art NFTs is the leading sector in the space, with a year-to-date return of 192% in ETH terms and 108% in USD terms.

At the other end of the spectrum was the gaming segment of the NFT market.

Despite being described by Nansen as the “fastest-growing segment of the NFT market,” gaming-related NFT collections saw the worst performance this year with a return of 42% in ETH and just 14% when measured in US dollars, the report said.

Further in the report, Nansen also said that the gaming-focused part of the NFT market is among the least volatile segments of the market.

The reason for this could be that the gaming segment is “mature and have an expanding user base,” Nansen hypothesized. As evidence for this, it pointed to the entrance of major companies such as Grayscale, which offers a Decentraland (MANA) investment trust, into the space as one factor that makes the related NFTs less volatile as an investment.

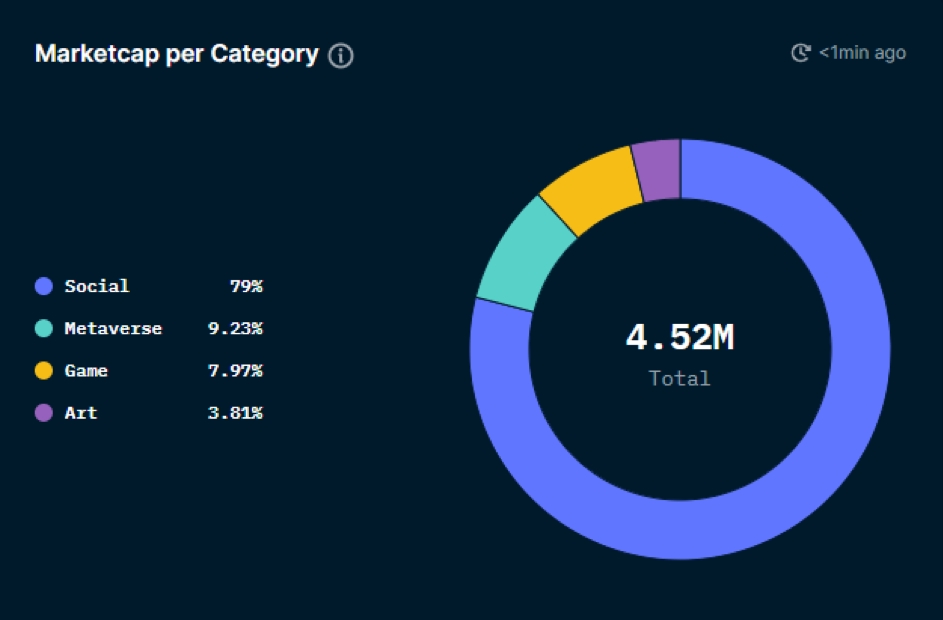

Worth noting is that the gaming segment only accounts for a relatively minor share of the overall NFT market, with a market share of close to 8%.

The biggest segment by far is what’s known as social NFTs, which include profile pictures for use in social media. This segment makes up a whopping 79% of the total NFT market, Nansen’s report said.

_____

– NFTs Will Become ‘Critical Pieces’ of Sports Industry – PwC

– Check These Ukraine NFT Projects Against the Russian Invasion

– NFTs in 2022: From Word of the Year to Mainstream Adoption & New Use Cases

– NFT Market Cools Down As Ukraine War Pushes Investors Toward Safe-Haven Assets