Trading in non-fungible tokens (NFTs) plummeted in recent days as geopolitical tensions and rising uncertainty pushed investors toward safe-haven assets.

Daily trading volume across major NFT marketplace OpenSea hit USD 50.8m on Saturday, down from a local all-time high of USD 247.8m reached on February 1, representing a decline of 80% in just more than a month.

Activity across other NFT marketplaces has also seen a steep drop-off, which is evident from the overall drop in activity in the whole market.

Total NFT sales across the entire market reached USD 167m on Monday, down from USD 924m recorded in late January 2022, representing a drop of around 82%, according to data by NonFungible.com.

Likewise, the number of NFT sales, the number of unique wallets involved in trading NFTs, and primary and secondary sales have all seen a drop of around 80% compared to local peaks reached at the end of February.

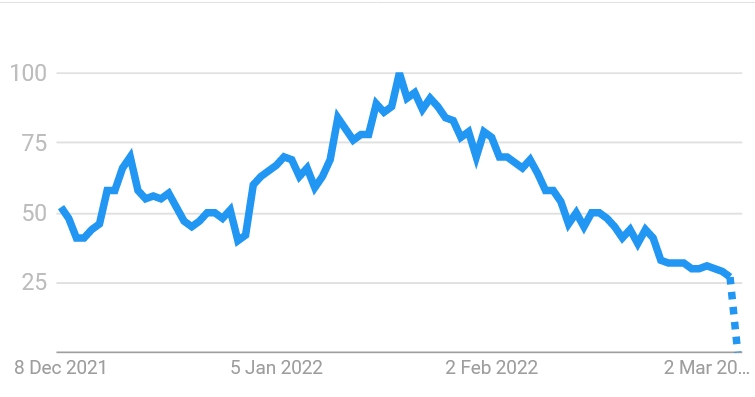

Furthermore, global “NFT” searches have seen a sharp decline, losing all the early 2022 gains and falling to early-November levels, according to data by Google Trends.

In early 2022, trading in NFTs picked up momentum after a number of high-profile companies dabbled in the industry by announcing branding and marketing deals.

For example, giant shoe manufacturer Adidas teased a partnership with the Bored Ape Yacht Club (BAYC), while Nike acquired RTFKT, a “metaverse-ready sneakers and collectibles” creator.

Nevertheless, investors are scrambling for safe-haven assets like gold as the Russia-Ukraine war rages on. On Monday morning, gold broke through USD 2,000 an ounce, while the crypto market was struggling to avoid losses.

____

– NFTs in 2022: From Word of the Year to Mainstream Adoption & New Use Cases

– ‘Russian Ethereum’, Waves, Almost Triples Since Ukraine War Began

– Ukraine Cancels Crypto Airdrop, Says It Plans to Issue NFTs Instead

– Utility Is the Future of NFTs

– US Regulator Launches Probe Into NFT Sales

– South Korean Court Rejects Challenge to Strict Crypto, NFT Gaming Law