Investors in funds backed by bitcoin (BTC) appear to be taking advantage of the lower prices, adding close to USD 299m to such funds last week, or the most this year, while ethereum (ETH) outflows more than doubled.

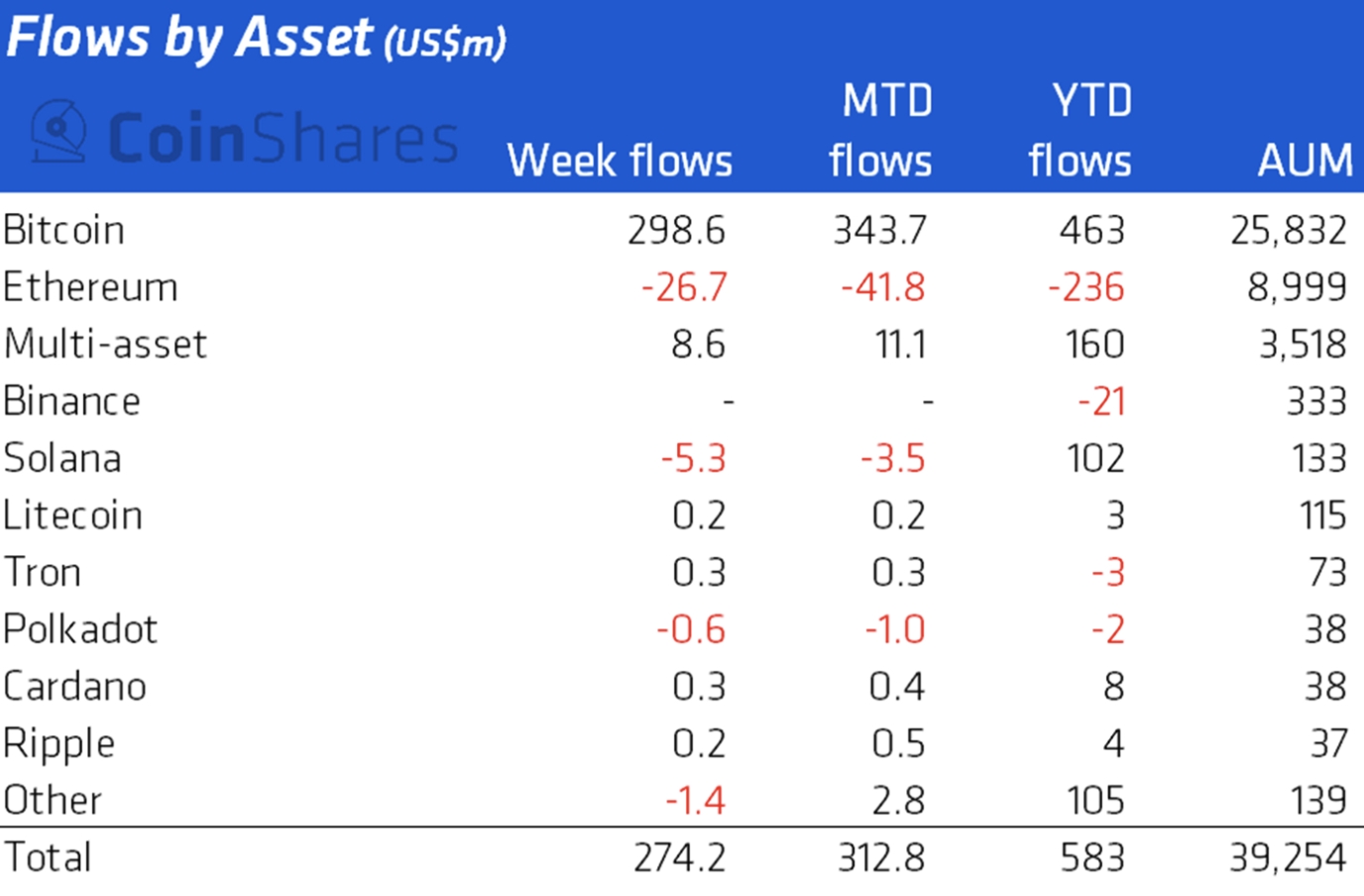

Per crypto investment and research firm CoinShares data, the inflows into cryptoasset-backed funds last week were the largest seen so far this year, led by almost USD 300m that flowed into BTC funds. However, due to outflows of nearly USD 27m from ethereum (ETH) funds and outflows of USD 5.3m from solana (SOL) funds, the net inflows for the week ended at USD 274.2m. A week earlier, BTC inflows reached USD 45m, while ETH saw outflows of almost USD 13m.

The BTC inflows are “a strong signal” that investors saw the collapse of terraUSD (UST) and the Terra network’s native LUNA token as a buying opportunity, analysts at CoinShares wrote. The strong inflows were also described as a flight to “relative safety” within the crypto ecosystem. In the past week, BTC dropped 12%, while other coins from the top 10 list dived 16%-28%. Still, some capital did find its way to so-called multi-asset investment products, with USD 8.6m in inflows.

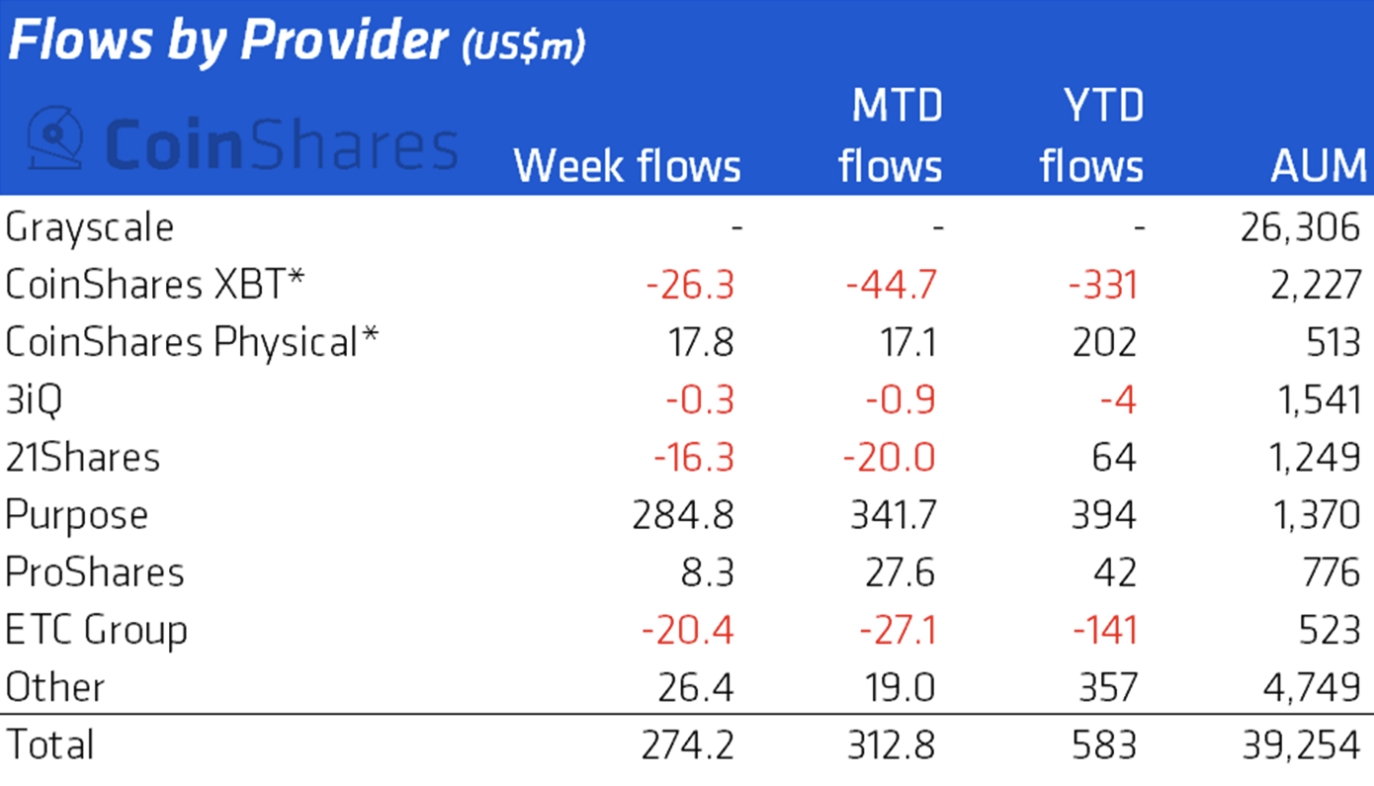

The positive outlook was not evenly distributed geographically. While North American investors were responsible for inflows of USD 312m for the week, a net outflow of USD 312m was seen from European investors, the data showed.

In the blockchain equity space, CoinShares said investors “panicked” over the UST collapse, puling out USD 51m in total. The outflow was described as the third-largest weekly outflow on record.

In terms of fund providers, Purpose, the company behind a Canada-listed physically-backed bitcoin exchange-traded fund (ETF), recorded the largest inflows for the week of USD 284.8m.

Institutional buying

Echoing CoinShares’ data, Ki Young Ju, CEO of the crypto analysis provider CryptoQuant, said earlier on Monday that institutional investors now have become net buyers of BTC with the help of market makers.

According to him, institutions have largely absorbed the BTC supply that has come from the UST collapse, as the Luna Foundation Guard (LFG) sold off its reserves in order to defend UST’s peg.

“I think institutions tried to stack BTC from USD 30k but had to rebuild the bid walls at USD 25k due to the unexpected LFG selling,” Ju said.

He followed up later by pointing to the confirmation that LFG has sold off the vast majority of its BTC reserves, saying that institutions on the Coinbase exchange have bought a lot of it.

_____

– Bitcoin Halfway to Next Halving – What Can History Teach Us?

– Ethereum Price Target for 2022 Cut Again But New Highs Still In Play – Survey

– ‘Nobody Big Enough’ to Manipulate Bitcoin, but Altcoins Offer Superior Returns, Pantera’s Morehead Says

– Two Clues for When Bitcoin Downturn Might End

– Bitcoin Price Forecast for 2022 Cut Once Again as Break ‘Only’ Above USD 80K Now Expected

– As Bitcoin Keeps Tanking, Arthur Hayes Joins Chorus of USD 1M BTC Predictors and Warns of ‘The Doom Loop’